Let us start on a positive note. Several key economic indicators nationally and internationally improved in June mostly around consumer spending and employment. Domestically, the unprecedented level of government support provided to individuals and businesses is working. As noted last month retail sales for April declined by a record 17.7%. This month retail sales data for May (released on July 3rd) rebounded by 16.9%. Food Retailing was up by 7.2%, household goods which includes hardware and garden supplies by 16.6%, department stores by 44.4% and other retailing by 9.4%. Foot traffic jumped sharply as stores reopened with the required social distancing protocols. Café, Restaurant and Takeaway food sales were also up by 30.3% albeit off very low levels and levels that remain well below pre COVID-19 levels. It is encouraging the level of consumer spending is currently running at levels above where one would expect given the level of uncertainty.

Our trade performance remains strong. Australia’s trade surplus (value of exports less value of imports) for May increased from $7.8 billion to just over $8.0 billion with losses in services exports such as tourism and education offset by continued resilience in commodity volumes and prices. Mining royalties would be one of the few major sources of government taxation revenue that is not falling sharply.

Weekly payroll jobs and wages in Australia to the week ending June 13th 2020 released by the Australian Bureau of Statistics (ABS) on June 30th showed payroll jobs increased by 1.0% between mid-May and mid-June and have continued to rise every week since the low in mid-April. According to the ABS the recovery in payroll jobs between mid-April and mid-June represents around 30% of the jobs lost initially.

The main negative economic indicators released this month included building approvals, engineering construction and home loan commitments which combined painted a bleak and deteriorating outlook for the building and construction sector and property values. Dwelling approval numbers for May fell by 16.4% with apartment approvals down 34.9%. The decline in apartment approvals was already evident before COVID-19 but it is exacerbating the impact on an already contracting construction sector. The value of new housing loans fell 11.6% in May. According to the ABS ‘this was the largest fall in the history of the series, driven by strong falls in the value of loan commitments in New South Wales and Victoria.’ Despite all the talk from Governments on infrastructure spending the value of total engineering work done was flat in the March quarter.

Our outstanding record in containing the virus and phased removal of restrictions ended abruptly this month. Melbourne is again in lockdown caused mainly by a failure in managing the quarantine system for returned travellers from international virus hotspots. The total number of daily new cases in Melbourne is now higher than the national daily peak during the first wave in March. Thankfully, new cases in other states are negligible to zero and restrictions continue to be eased. Outside Victoria intrastate travel restrictions have been removed and the QLD and NSW borders are open to all residents other than Victorians. Cafes, restaurants, pubs, accommodation, and most entertainments venues are all open outside Victoria, subject to state based social distancing protocols. This is a great outcome for 75% of Australia’s economy.

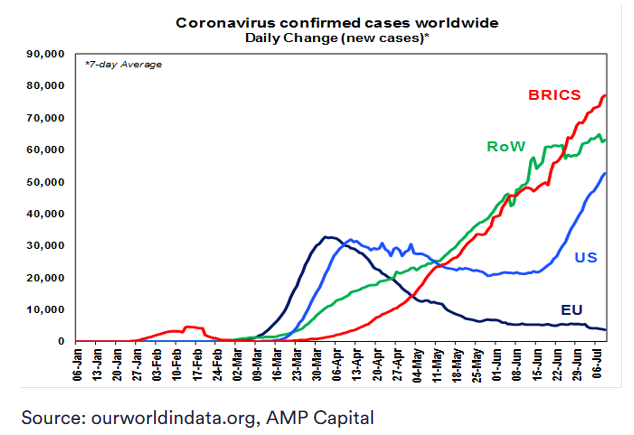

Internationally the number of new infections continued to climb with few signs of the curve flattening. While the UK and Europe appear to be over the worst, the number of cases continues to climb in the USA and the developing world.

But where to from here. We cannot lock down the economy indefinitely or the cure will be far worse than the disease. Earlier diagnosis and better treatments are reducing death rates which remain largely confined to those over 80 and/or those with underlying health conditions. Keeping this cohort out of harm’s way should be the focus. Our health system is well prepared to cope with any new outbreaks and it now appears highly probable more will occur. Eradication is unlikely in the short term. A vaccine is probably at least 12 months away. Managing outbreaks through tracing, quarantining, social distancing, wearing masks etc looks like the better option.

One of the major criticisms is the lack of context and balance in reporting on the virus. Yes, every death is tragic, but mass hysteria and fear seem to be the main game increasing uncertainty and undermining already fragile business and consumer confidence. As I write 107 people have died in Australia from COVID-19. This represents on average less than one per day since early March. The total number of deaths from all causes in Australia last year was 147,000 or 403 deaths per day. In calendar 2019 there were 313,061 cases of influenza in Australia. Each year the flu kills between 1,500 and 3,000 Australians, again mostly among the elderly. Over the five-month flu season this translates to 10 to 20 deaths per day, 10 to 20 times above the daily death rates to date from COVID-19. Lock downs and social distancing has meant the number of influenza cases so far this year is significantly lower than usual meaning in net terms lives at least to date have been saved.

The shutdown in Melbourne is likely to dent already fragile business and consumer confidence and increase the severity of the recession in the nation’s second largest state. The road to recovery for the nation now looks a little longer and bumpier.

Disclaimer:

Material contained in this publication is an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.

This publication is confidential and intended only for current clients and prospective clients of Royston Capital and their professional institutional advisors only and is not to be provided to other persons.

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in investment funds advised by, or the advisory services of, Royston Capital. This publication contains general information only and does not consider your personal objectives, financial situation or needs and so you should consider its appropriateness having regard to these factors before acting on it.

No legal or tax advice is provided. Any taxation position described in this publication should be used as a guide only and is not tax advice. You should consult a registered tax agent for specific tax advice on your circumstances. Recipients should independently evaluate specific investments and trading strategies.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this presentation or copies of it and agrees not to make use of the publication other than for its own general information purposes.

The views expressed in this publication represent the opinions of the persons responsible for it as at its date and should not be construed as guarantees of performance with respect to any investment. Royston Capital has taken reasonable care to ensure that the information contained in this publication has been obtained from reliable sources, but no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. Royston Capital does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events.

Past performance is not necessarily indicative of future results. In addition, the price and/or value of and income derived from any investment may vary because of changes in interest rates, foreign exchange rates, operational or financial conditions. Investors may therefore get back less than originally invested. Furthermore, these investments may not be eligible for sale in all jurisdictions or to certain categories of investors. Portfolio performance is based on a theoretical model portfolio, returns for individual investors may differ.

Royston Capital, nor its associates, does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication.

© 2020 Royston Capital Pty Ltd. All rights reserved. No part of this publication may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of Royston Capital Pty Ltd.

Sources: Commbank Global Markets Research, RBA, Morningstar.