Portfolio Management

Growing your wealth through a range of high conviction low turnover portfolios with clear ownership and complete transparency.

Growing your wealth through a range of high conviction low turnover portfolios with clear ownership and complete transparency.

When investing in Australian equities we look for companies that demonstrate real Market Opportunities for Profitable Products or Services with Competitive Advantages and Barriers to Entry. The first elements make a business possible, the last elements make it a good and enduring business; without these, competitors enter to drive costs up and prices down ultimately eroding the company’s competitive advantage.

Other characteristics we seek include:

S&P ASX 200 Accumulation Index

Companies in the S&P ASX 300 Index.

Generally 20-25

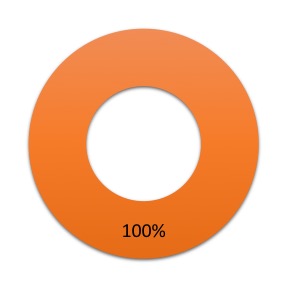

The portfolio aims to be fully invested but generally has up to 3% cash at any one time and is otherwise unrestricted.

When investing in interest bearing securities we seek preservation of capital while also seeking attractive income streams. We consider the following variables:

Bloomberg Ausbond Bank Bill Index

Generally 8-12

The portfolio aims to be fully invested but generally has up to 3% cash at any one time and is otherwise unrestricted.

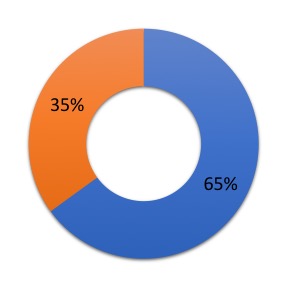

This portfolio has been designed for those with a smaller balance in self-managed superannuation fund, or seeking to address Division 293 tax issues. However, the portfolio can be applied to other investment structures.

This portfolio is based on the Core Australian Equites portfolio. A self-funding installment is used as the alternative to purchasing the ordinary share.

Where there is no self-funding installment an alternative may be selected otherwise the ordinary share is purchased. Self-funding installments are a geared investment and are weighted in the portfolio by its exposure to the ordinary share.

The overall aim of the portfolio is to maximize the use of franking credits, gearing and growth assets to assist those seeking a high growth, low cash flow strategy to grow their wealth.

S&P ASX200 Accumulation Index

Generally the Royston Capital Core Model portfolio with self-funding installment warrants replacing said investments where available.

Generally 20-25

The portfolio aims to be fully invested but generally has up to 3% cash at any one time and is otherwise unrestricted.

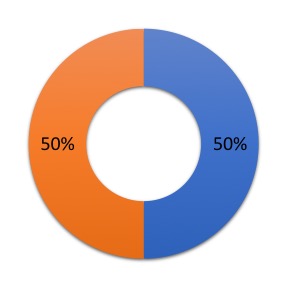

One of the most effective means of reducing risk is to diversify your portfolio. You can reduce volatility by ensuring that your investment portfolio is not over exposed to any one type of asset class, sector or style.

Effective asset allocation has been proven to be a key determinant of long-term portfolio returns as has the duration of investment.We can offer a diversified portfolio with consolidated reporting. We provide you with a tailored investment mandate based on our discussions about your tolerance to risk and return and your investment objectives.

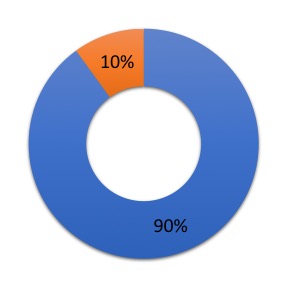

We construct our diversified portfolios based on three classifications for risk tolerance; low, medium and high risk, and provide three potential portfolio choices depending on your investment requirements.

Our blended portfolios leverage the single asset class portfolios and may also include illiquid assets such as property syndicates, venture capital and private equity and other alternative assets depending on individual needs for diversified investment strategy.

Weighted average of indices in line with the pre-determined asset allocation or CPI + as agreed with you.

Royston Capital investment portfolios and other non-liquid investments such as property syndicates private equity and venture capital.

N/A

As agreed or by the pre-determined asset allocation.

Please contact us to find out more about our current strategic asset allocation view.

When investing in interest bearing securities we seek preservation of capital while also seeking attractive income streams. We consider the following variables:

Bloomberg Global Bond Aggregate Index (Hedged AUD)

Generally 6-10

The portfolio aims to be fully invested but generally has up to 3% cash at any one time and is otherwise unrestricted.

Our Portfolio Administration System (P.A.S.) can record and report on all your assets (listed and unlisted) to provide a holistic view of your portfolio.

Importantly, our administration meets AASB GS007 audit requirements and portfolios come with an annual audit certificate that confirms the accuracy of the portfolio reports.

Click here to download the flyer

The Royston Capital Investment Committee ensures investment decisions are consistent, structured and unbiased and that appropriate investment due diligence framework is maintained at all times.

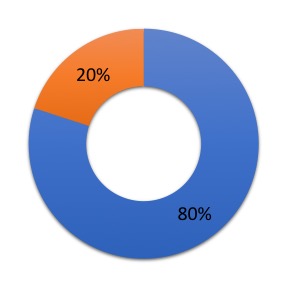

At Royston Capital, we believe that Risk Management of portfolios is critical to the ongoing success and out-performance.

Investment risk is limited by appropriate diversification both within and between asset classes.

Currency risk is managed by appropriate hedging arrangements.

Consideration of ethical investment principles and practices are a critical element in the process for the selection of funds managers where appropriate and will be taken into account as part of the reporting process by Royston Capital.

Our investment philosophy is built around 6 core views:

Where appropriate for clients of Royston Capital, the Committee will endeavour to recommend investment opportunities that provide good financial returns and at the same time respectful of the world in which we live.

Thus the Committee will seek to avoid, within the limits of reasonable feasibility, having client monies invested with any investment manager or in an individual security which has substantial holdings in companies whose principal activity

However, to the generally limited extent that its investment style (and policy) will make possible, the Committee will also seek to have a voice (direct or indirect) in influencing the attitudes and practices of the corporate development and management sector in relation to ethical issues and so will not be absolute in adopting a negative screening strategy.

Click here for further information about our Investment Philosophy.